Index

ToggleTrade Tune

India and the United States announced the historic India-US Trade Deal on February 2, 2026, and it was a dramatic change in the global economic scene. This agreement has created an opportunity for a 32 percent margin to Indian exporters by reducing the effective 50 percent reciprocal tariffs of the US on Indian goods to a fixed rate of 18.

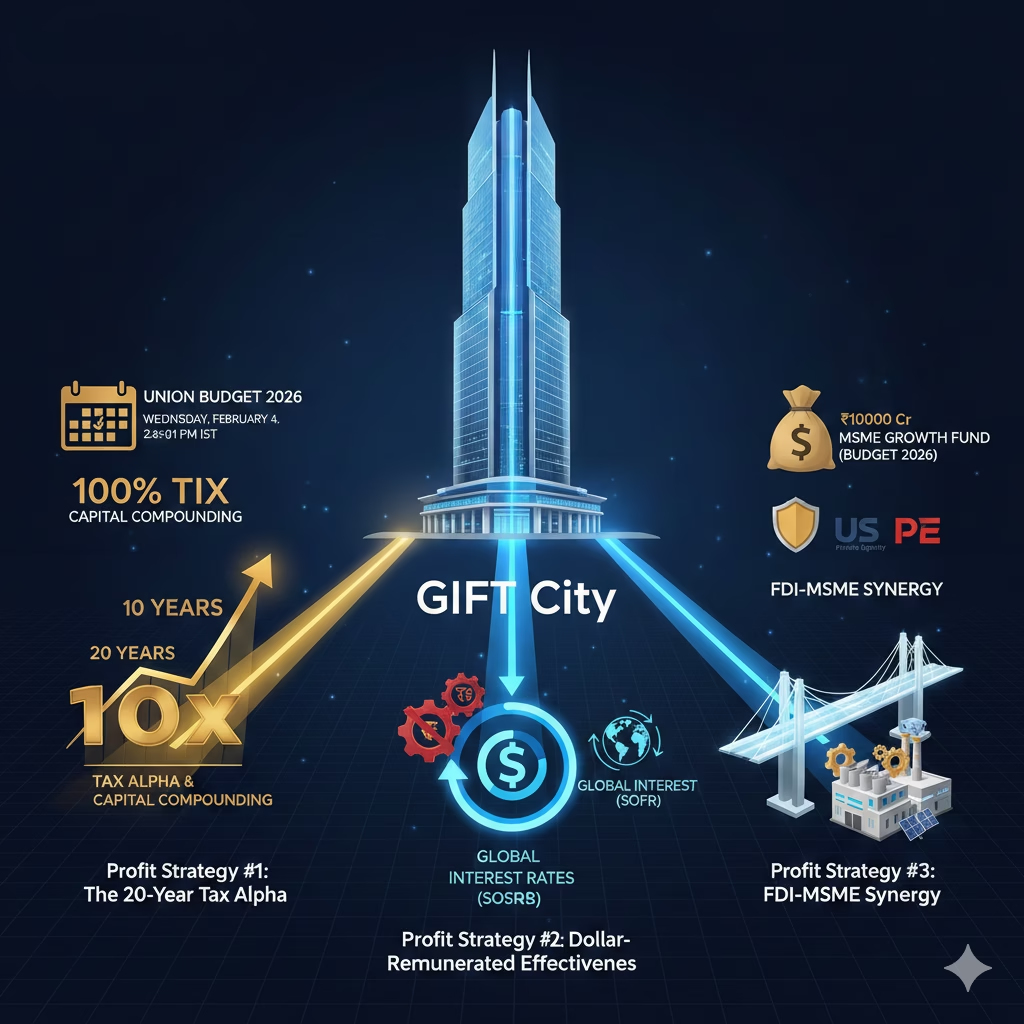

This innovation, together with the move by the Union Budget 2026 to further the GIFT City tax holiday to 20 years, marks the Golden Era in Indian business.

The IFSCA Gift City is the most efficient, tax-optimal, and globally competitive channel of accessing this US market reset.

I. Executive Summary: The 2026 Trade Tsunami

The trade potential in India has skyrocketed in the early months of 2026. The punishing 25% Russian Oil Penalty has been torn down, after the India-US Trade update in February, and after the punishing 25% India-EU Mother of All Deals in January.

The government has made the International Financial Services Centre (IFSC) the strongest Tax-Neutral Export Gateway in the world by harmonizing US tariffs at 18 percent and providing the GIFT City tax holiday, which is 20 years.

This shift is now a strategic requirement for Indian business leaders.

II. Impact Analysis: India has an 18 percent advantage over the world’s competitors

The US tariff of 18 percent is fixed, which gives India an upper hand in the structure compared to its nearest manufacturing rivals.

A. Regional Preeminence: A Sharp Pricing Competitiveness.

India has now got a great bargaining capability in the American market, and thus, Made in India is the most lucrative option available in the eyes of the American importers.

| Country | Effective US Tariff (2026) | India’s Strategic Advantage |

|---|---|---|

| India | 18% | Market Leader |

| Vietnam | 20% | +2% Price Edge |

| Bangladesh | 20% | +2% Price Edge |

| China | 34% | +16% Massive Lead |

B. High-Growth Sector Winners

- Textiles and Apparel: As the US is among the key destinations, 18% duty will render Indian apparel much more competitive than South-East Asian competitors.

- Solar and Green Tech: Makes the US market not only a high-risk market but also a high-opportunity market, which enables the Indian manufacturers to confront the dominance in the global market.

- Speciality Chemicals and Pharma: Recovers 30-40 percent of revenue, within the view of generic pharmaceutical companies that were previously victimized by retaliatory duties.

Check it out!

Learn more about International Financial Service Centre (IFSC) Consulting and how GIFT City structures can unlock global investment efficiency.

IFSCA-C →

III. Profit Strategy #1: The 20-Year Tax Alpha

Expansion of the 100 per cent tax holiday of 10 to 20 years by the Union Budget 2026 is a game changer to units of IFSCA Gift City.

The Power of Reinvestment

You are paying up to 35 percent in corporate taxes in the mainland, which is depleting your growth capital. At GIFT Cit,y there is no tax payable in the first 20 years,s and the remaining tax is a flat rate at 15 percent. This will enable you to reverse 100% of your US export income in R&D and capacity development over the next 20 years.

Scale: Strategic Workflow: Tariff Savings to Scale.

- Export Goods: Use the US 18 percent tariff.

- Passage through GIFT City: Take advantage of the 20-year tax holiday.

- Capital Compounding: Reinvest tax savings into 10x business scaling.

IV. Profit Strategy 2: Dollar-Remunerated Effectiveness

Working in the IFSC, you can avoid Currency Friction.

- Zero Hedging Costs: You have saved the 2-3% that is being lost in converting the Rupee into the Dollar by transacting and maintaining balances in the USD.

- Global Interest Rates: Trade finance globally at IFSC Banking Units (IBUs) and at global SOFR interest rates, which are considerably lower than domestic Indian interest lending rates.

V. Profit Strategy 3: FDI-MSME Synergy

The equity is given by the 10000 Cr MSME Growth Fund (Budget 2026) to modernize, and GIFT City gives the entry point to Foreign Direct Investment (FDI).

GIFT City is becoming the safest Tax-Neutral entry point for US-based Private Equity firms to invest in Indian exporters. With establishment in the IFSC, your MSME is now investment-ready in regard to the multi-billion-dollar inflows of capital that are projected to come into the US.

VI. GiftCityAdvisor has the potential to make you grow in the following ways

We are the regulatory heavy lifters as your professional IFSCA Consultant, so that you can grow internationally.

- Rapid Track: Within a 4-8 week period, we simplify the registration of IFSCA and the setup of the bank.

- Mastery of Compliance: FEMA, RBI, and SEBI compliance of US bound trade finance.

- Strategic Structuring: The Maximum 20-year tax benefits of your Regulatory Fit Checker.

How and What

These FAQs address the most common questions around tariffs, GIFT City advantages, MSME funding, and how Indian businesses can scale globally under the evolving trade and policy framework.

Is the 18% tariff on Indian commodities fixed?

No. While an 18% tariff applies broadly, recent trade negotiations have significantly reduced the earlier 50% tariff “cliff” for key industries such as Textiles and Solar. This opens new export opportunities for Indian manufacturers across multiple industrial segments.

Why is GIFT City a better place to trade with the US compared to mainland India?

Mainland companies face higher taxes and currency hedging costs. In contrast, GIFT City offers a 20-year tax holiday and operates in a USD-denominated banking environment. This structure can improve net income by approximately 15% through tax and cost efficiencies.

What was the Russian oil penalty and what changed in 2026?

The US had imposed a 25% penalty tariff on countries purchasing Russian oil. Under the February 2026 agreement, this penalty is removed provided India diversifies and shifts its energy sourcing away from Russia.

How is the MSME Growth Fund connected to GIFT City?

The MSME Growth Fund provides domestic equity support for technology upgrades and capacity expansion. GIFT City complements this by enabling global FDI access, allowing MSMEs to scale operations and enter the US and other international markets.

How do I get started?

Begin with a professional GIFT City consultant such as GiftCityAdvisor. An advisor helps design the correct licensing, regulatory, and tax-neutral structure so your business can scale compliantly and efficiently.

Recommendation: The Future of India-US Trade

The US Tariff Reset; 18% is the largest of the decade export prospects. The IFSCA Gift City, together with the 20-year tax holiday, is the only logical option that the high-growth businesses have.

Plan your US Export Strategy with Contact GiftCityAdvisor Today!